Over*Flow: “The Sun is Shining on AMC”: Meme Stocks & (Temporary?) Media Industry Reorganization

Peter Arne Johnson / Boston University

Over the past few weeks, there has already been extensive journalistic coverage of the “meme stocks” that have washed over not only the financial world but also popular culture. The phenomenon first caught the financial media’s attention when a community of retail investors from the subreddit r/wallstreetbets started to purchase, en masse, shares of the “brick and mortar” video game retailer GameStop (NYSE symbol GME). The stated goal of the self-named Wall Street Bets (WSB) page was to take down greedy hedge fund managers and “short sellers” who have manipulated the market and profited from financial disasters like the 2008 financial crisis. Facilitating a “short squeeze,” which occurs when an investment pool drives up the price of a shorted stock to increase the losses for the short seller, the Reddit community drove up the struggling GME stock from a year-to-date low of $2.57 to a peak closing price of $347 on January 26, 2021.

Often overstated as a David vs. Goliath matchup between average citizens and institutional investors, meme stocks have come to embody a populist movement, with Americans taking out their frustrations on Big Money after years of deceitful and manipulative practices perpetuated by hedge funds, private equity firms, and other institutional investors. However, such a simple dichotomy overlooks the political economy of our financialized economy and the complex ripple effects of meme stocks on financial markets and underlying ownership structures, including those in media industries. Additionally, positioning this as a populist, class-based revolt ignores the institutional investors and financial elite who have profited from this spike in prices. In fact, nine institutional investors already made $16 billion on the GME raid alone.

While GME has garnered much of the recent media attention, AMC Entertainment Holdings, the largest movie theater chain in the United States, has experienced a more significant structural shift as a result of meme stocks. Moreover, the coverage of the meme stock movement has overlooked the extent to which meme stocks further evidence the financialization of not only the global economy but also culture and cultural institutions.

Meme stocks represent a supercharged version of the digital-era phenomenon of “participatory culture.”[1] This time, user engagement has been injected with Jordan-Belfort-levels of adrenaline. Throughout U.S. financial history, however, there are precisely zero examples of populist retail-driven bull raids—largely due to the lack of a networking mechanism like social media to drive collective action. Institutional investors, on the other hand, have frequently leveraged the press and the media to drive stock prices up or down in order to make short term gains at the expense of other investors.[2] With social media sites like Reddit and their network effect, individual investors now can digitally congregate and make financial decisions (and execute them) as a group.

Within the cultural history of Reddit, users have defined “meme stocks” as “stocks that are popular for younger adults [and they] are typically ‘meme’ stocks due to their high volatility. Most of them are popular tech stocks with high sentiment.”[3] One Redditor in 2020 claimed to have engaged in “meme stock” trading for over three years, so this trend has been growing since at least 2017. Although there is no simple way to chart their origin, “meme stocks” have previously had tangible effects on stocks like Tesla and Virgin Galactic—though, these have garnered no discernable media coverage.[4] With newfound disposable income from federal stimulus checks, increased leisure time, especially for those who may be unemployed, and fewer opportunities for sports betting, many more Redditors have turned to Wall Street day trading, which altogether has significantly increased retail trading activity.[5]

Although there are sometimes sound logic and concrete financial strategies undergirding these WSB bull raids, many Reddeners openly admit that their motivations are not merely financial or activist, as they are also in it “for the lolz.” The irreverent, pop-cultural ethos of WSB is best embodied in its subreddit banner, which depicts a Wolf of Wall Street-esque avatar in a suit and sunglasses in front of a luxurious yacht.

Meme stocks can also be contextualized within the broader phenomenon of financialization, which refers to the increasing importance of financial entities and the financial sector in all aspects of the economy and culture, particularly since the rise of deregulatory policies in the 1970s.[6] Not only has financial terminology like “short selling” and “bull raid” migrated from niche professional sectors to popular culture, but the capitalist ideologies driving meme stocks represent larger phenomenon, whereby the finance sector has infiltrated nearly all aspects of daily life. In addition to increased media coverage, the rise of meme stocks has, for example, led to the emergence of many new TikTok accounts that educate young and financially inexperienced users about investing and (seemingly) complex concepts like short selling.

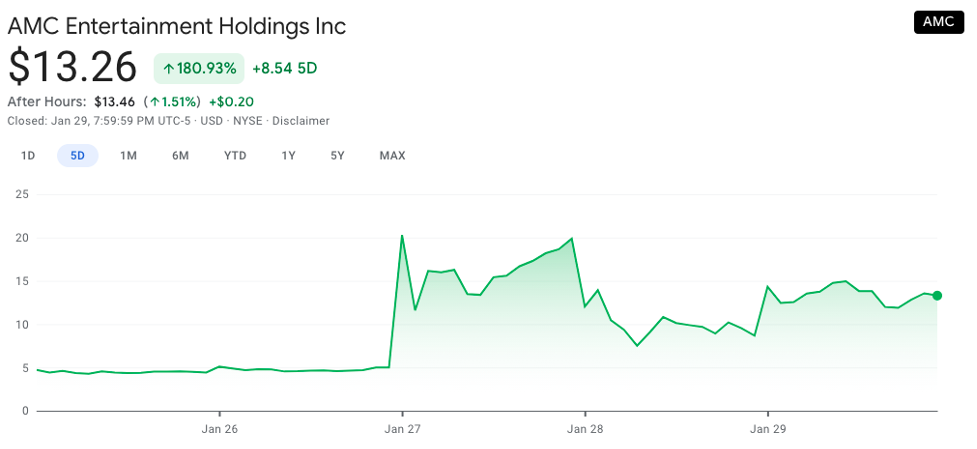

Although “meme stocks” may very well be a joke to some and an unexpected short-term gain for others, the theater-chain AMC has seen tangible benefits after its price surged due to WSB’s support. On January 27, 2021, AMC’s price shot up from approximately $5 to over $20 per share. Unlike companies like GameStop, AMC was able to parlay its speculative market value into an actual institutional benefit. The company, which has been increasingly leveraged as a result of the COVID-19 pandemic, the shuddering of theaters, and the collapsing of legacy theatrical windowing, used this opportunity to decrease its outstanding liabilities.

Specifically, on January 27, when its stock jumped four-fold, AMC was able to permanently eliminate $600 million worth of debt previously held by the private equity firm Silver Lake Partners, which converted AMC bonds into equity.[7] Regardless of whether this stock surge will be permanent or will continue to fall victim to the perennial vicissitudes of market speculation, AMC’s debt reduction is notably not temporary.

This debt reduction subsequently caused an even more significant industry reorganization. By Friday of the same week, Silver Lake sold off its just recently converted equity, providing a total gain of $113 million from the “meme stock” bump; with this gain, the PE firm dumped its 21% ownership stake in AMC, which it had picked up in 2018.[8] Also, just earlier that week, AMC had raised nearly $1 billion in additional capital.[9] Declaring that “the sun is shining on AMC,” AMC CEO Adam Aron concluded that any possibility of bankruptcy—which was previously a serious and imminent concern throughout the pandemic—was virtually off the table for 2021.[10]

Silver Lake’s divestiture was significant, especially considering the extractionary nature of private equity firms, who typically acquire/invest in a firm, run up its debt, reduce its costs (i.e., fire employees, reduce benefits), increase prices, and ultimately sell said company for parts.[11] As Andrew DeWaard has noted, Silver Lake holds other notable financial positions in entertainment companies, including Endeavor talent agency, Cast & Crew, Media Rights Capital, Endeavor Content, IMG Original Content, Raine, and WME Ventures.[12] Unlike other PE firms, Silver Lake appears to target entertainment, technology, and media firms–perhaps relying on niche expertise to drive extraction decisions, rather than broad-based knowledge. Through its underlying financial ownership, Silver Lake had created what deWaard calls a “shadow studio.”[13] Silver Lake’s structure is both paradigmatic of and a product of the increasing financialization of media. Its cross-holdings suggest that Silver Lake is/was re-creating a vertically integrated conglomerate—though, notably without the “synergies” of concentrated organization.

Silver Lake’s quick sale of AMC’s stock also suggests that the firm’s interest in AMC—and perhaps in these other entities—has been driven by short-term, extractionary profits. As deWaard notes, this extractionary process can be extremely harmful to consumers and industry workers. The adverse effects include “laying off high-wage labor, reducing wages and benefits, intensifying workloads, and shifting to non-unionized workers.”[14] For consumers, private equity ownership, and common ownership in general, can result in decreased competition, less product diversity, and (as most moviegoers are well aware) increased prices.[15]

Now that Silver Lake is out of the picture, does this mean that the composition of AMC’s shareholders (or perhaps that of other media shareholders) will increasingly consist of small retail investors, rather than large manipulative institutional investors? Does Wall Street Bets signal a more equitable political economy in the financial and media sectors? Is this the death knell of financialization and institutional ownership? You already know the answer: probably not.

While AMC’s physical assets may make it slightly less risky than the typical U.S. media company, it is nonetheless subject to the vicissitudes of both market speculation and cultural production, which is already riskier and more uncertain compared to other industries that have more substantial “brick and mortar” assets and predictable economics. Cultural production is, therefore, inherently vulnerable to speculation in an already financialized economy. Nonetheless, even if AMC’s stock prices return to their rock-bottom levels, “meme stocks” have provided a fundamental change in the composition of the company.

Although the fate of AMC’s stock and the future of meme stocks are for market prognosticators to debate, Silver Lake’s bond conversion and subsequent divestiture in AMC materially resulted in an inertia of financial good fortune for AMC that may have provided the company with enough longevity and discursive capital to survive the pandemic without facing bankruptcy (though, it is uncertain whether bankruptcy would have even been so bad for AMC). Further, Silver Lake’s stage-left exit from AMC ownership foregrounds the extractionary nature of private equity firms—this area of study (media financialization) should remain an area that media activists are attuned to. With the height of the pandemic, Wall Street Bets, and financial uncertainty seemingly in AMC’s rearview, the exhibitor now has another David-cum-Goliath to contend with: streaming services like Netflix and Disney+. So, despite the bright sunshine on AMC today, it may not be out of the woods and into the daylight just yet.

Image Credits:

- A meme from r/WallStreetBets, combining the glamor of Martin Scorsese’s The Wolf of Wall Street with the banality of a brick-and-mortar GameStop retailer. (author’s screen grab)

- A Twitter user pointing out the invasion of institutional investors into meme stocks. (author’s screen grab)

- The former homepage banner (as seen on January 26th, 2021 via Internet Archive Wayback Machine) for r/wallstreetbets/. (author’s screen grab)

- TikTok user @tradertoks explaining WSB’s “short squeeze” of GameStop. (author’s screen grab)

- “Theatre Closed” signs outside an AMC location amid the COVD-19 pandemic.

- AMC’s 5-day stock price from January 25 to January 29, 2021. (author’s screen grab)

- Henry Jenkins, Convergence Culture (New York: NYU Press, 2006). [↩]

- Charles Geisst, Wall Street: A History, 4th ed. (New York: Oxford University Press, 2018), 25. [↩]

- “What is a meme stock,” Reddit, accessed January 31, 2021, https://www.reddit.com/r/stocks/comments/89iet9/what_is_a_meme_stock/. [↩]

- “Meme stocks of the past,” Reddit, accessed January 31, 2021, https://www.reddit.com/r/stocks/comments/gj36wi/meme_stocks_of_the_past/. [↩]

- Frank Van Dyke,” The Renewed Rise of the Retail Investor,” Global X (Blog), October 15, 2020, https://www.globalxetfs.com/cio-corner/the-renewed-rise-of-the-retail-investor/. [↩]

- Andrew deWaard, “Financialized Hollywood: Institutional Investment, Venture Capital, and Private Equity in the Film and Television Industry,” JCMS: Journal of Cinema and Media Studies 59, no. 4 (Summer 2020): 54–55, DOI: 10.1353/cj.2020.0041. [↩]

- Owen S. Good, “‘Meme stock’ rally rescues AMC theaters from $600M debt,” Polygon, January 29, 2021, https://www.polygon.com/movies/2021/1/29/22256360/amc-stock-price-reddit-rally-robinhood-debt-conversion. [↩]

- Ed Lin, “Major AMC Shareholder Silver Lake Sells Entire Stake for $713 Million,” Barron’s, January 29, 2021, https://www.barrons.com/articles/amc-entertainment-investor-silver-lake-sells-stake-51611962182. [↩]

- “AMC Raises $917 Million of Fresh Investment Capital Since Mid-December of 2020,” AMC Investor Relations, January 25, 2021, https://investor.amctheatres.com/newsroom/news-details/2021/AMC-Raises-917-Million-of-Fresh-Investment-Capital-Since-Mid-December-of-2020/default.aspx. [↩]

- “AMC Raises $917 Million.” [↩]

- deWaard, “Financialized Hollywood,” 67. [↩]

- deWaard, 69–70. [↩]

- deWaard, 70. [↩]

- deWaard, 63. [↩]

- deWaard, 60. [↩]

i was reading throught some of the posts and i identify them to be plumb interesting. abject my english is not exaclty the very best. would there be anyway to transalte this into my argot, spanish. it would really help me a lot. since i could be on a par with the english terminology to the spanish language.