“Streaming Wars and the Future of Video,” It’s Not What You Think…

Siobhan O’Flynn / University of Toronto

Recent and current discussions of the “streaming wars” have tended to focus on two data points: the number of subscribers a given OTT platform has quarterly and the fragmentation or distribution of content for consumers across streaming platforms.

To the first point, discussions typically cite numbers for US domestic or US/Canada North American subscribers, where Canada accounts for roughly 10% of the total, and with the launch of Disney+, how Netflix has been impacted (rise/fall). A contributing factor since Disney’s 2017 announcement has been Disney’s pulling content from Netflix as licensing agreements ended. So, with the launch of Disney+, all Pixar, Lucas Film/Star Wars, Disney Studio titles are gone and as this content appears on Disney+, that data stream of organic user behavior will now be Disney’s. Where pre-existing licensing (2012) and co-production agreements gives Netflix streaming rights to a number of Marvel MCU movie titles and the Marvel Defenders series (Daredevil to The Punisher ), Disney+ is pitching to fans with original MCU series, WandaVision (2020), Loki (2021), and The Falcon and the Winter Soldier (2020).

The Walt Disney Company’s (TWDC) purchase of 20th Century Fox in 2019 now makes it the juggernaut of streaming content, as assets include multiple studios and beloved TV series, from The Simpsons (now streaming all 30 seasons ad-free) to The X-Files (1993-18), Buffy, the Vampire Slayer (1997-03), Modern Family (2009-20), Arrested Development (2003-present), 24 (2001-14), and Family Guy (1999-present), and more.

As of early Feb. 2020, Disney+ has 28.6 million subscribers, and subscribers are up to 30.7 million on subsidiary Hulu. The Star Wars spin-off, The Mandalorian (2019-present), has been a key factor, though a Dec. 2019 survey revealed that viewers preferred Disney Classics slightly ahead of Star Wars content (22%/21%), with Marvel at 15%. A survey in Jan. 2020 saw that preference for Disney Classics rose to 54%. Critically, though, even with Netflix’s rocky 2019 numbers in the US, data shows that the streaming war is not a zero-sum game, as the trend is for subscribers to have multiple accounts, with 60% of people surveyed keeping Netflix vs. Disney, and 80% of Disney+ subscribers having Netflix accounts. Amazon Prime’s numbers (high) are skewed as Prime Video is bundled with other Prime services. Projections that Netflix’s “salad days may be over” in the US market because it has reached “subscriber peak” fundamentally misunderstand Netflix’ business model.

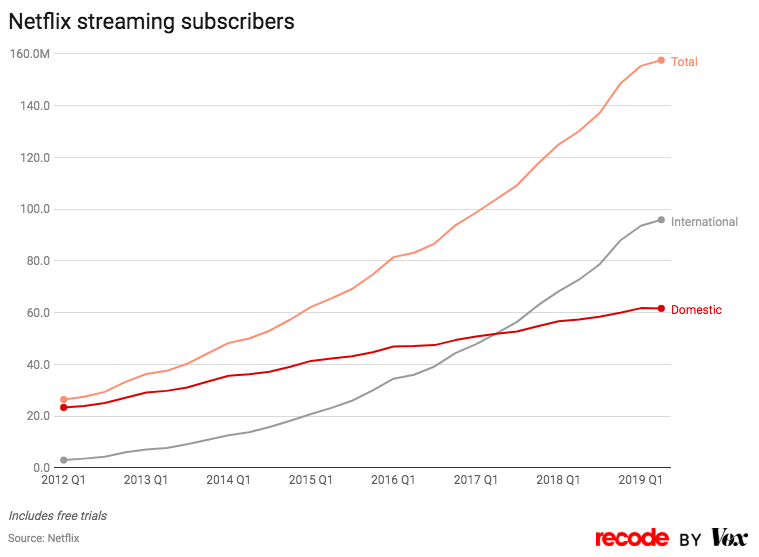

Since its Jan. 6, 2016 launch in 130 countries (excluding China, North Korea, Syria, and Crimea), Netflix has invested heavily in its global reach via local content development, including local language original series being filmed and produced in 13 countries in 2017 (including Mexico/Narcos, India/Lust Stories and Sacred Games, and Japan/Terrace House and Midnight Diner: Tokyo Stories, and original anime titles). Netflix’s global expansion strategies have included hiring what it claims is the best cadre of colloquial translators worldwide: “Our desire [is] to delight members in “their” language, while staying true to creative intent and being mindful of cultural nuances is important to ensure quality.” Seamless dubbing in addition to subtitles have contributed to Netflix’s consolidation of global dominance, evident from July 2017, when Netflix’s international subscribers surpassed US subscribers in the 2nd quarter with 52 million and 51.9, respectively. Netflix is now available in over 190 countries, with data for 2019 reporting that “[i]nternational markets accounted for about 90% of Netflix’s growth” and worldwide subscribers are 167 million with 60 million in the US.

CEO Reed Hastings has been blunt about dominating internationally, stating in Feb. 2018, “The next 100 million users of Netflix will come from India.” As of Dec. 2019, Netflix committed a 30 billion INR investment in local content in India. This global market goal impacts content development in other ways, as Netflix has taken a mobile-first approach to leverage the Indian market, having launched a 199 INR mobile plan to expand subscribers in Sept. 2019. As of Feb. 2020, now ex-CEO Bob Iger signaled Disney’s intent for international expansion, aiming for the Indian subscriber market & European countries, putting expansion plans for Hulu on hold. Notably, though, Disney is not yet producing local content nor has it signaled a “mobile-only” model for subscribers, which Netflix is now also offering in Malaysia.

To focus on a perceived agonistic struggle for viewers in the US between Disney+ and Netflix further misunderstands the function that content plays in each distinct media “scape” (to borrow Arjun Appadurai’s term). Netflix’s strategies relies on a small listing of top-tier, attention grabbing content (Scorcese’s The Irishman), potential breakouts (Stranger Things), beloved titles such as just licensed Studio Ghibli films (to all markets except the US, Canada, and Japan), and then thousands of good-enough titles that will keep you watching once your intentional viewing ends. In 2020, Netflix straddles multiple different content domains, from Oscar contenders, to family, child-directed live and animated series, and locally produced films and series.

Netflix’s titles are exportable across national markets, particularly with animated series, and again, production can be quick and at a much cheaper scale, as they are not drivers of franchise expansion at the Disney scale. As Andy Yeatman, Netflix’s director of global kids content, made explicit in 2016, kids are “a captive audience” and, “We have a ton of data on what they watch, so we know what properties resonate and when they don’t—when (viewers) have had enough of a franchise and when they can’t get enough of it,” and further, “We always try to feed that demand so they always want more.” Note too that, unlike broadcast, because Netflix remains committed to being ad-free, (1) viewer data remains in-house (no third-party sharing) and (2) content decisions are not concerned with potential advertisers. As such, Netflix technically skirts data privacy violations that have dogged Alphabet’s subsidiary companies, YouTube, YouTube Kids, and Google’s Android/Play store.

Reframing the streaming wars from a global perspective, the distinction between Netflix and Disney+ is ants and elephants. Clearly a further benefit of Disney+ for TWDC is that organic user behavior data that used to be inaccessible in Netflix’ black-box recommendation AI, now exists in-House-Mouse. Viewer data can be integrated with insights from other market segments (online websites, games, purchases, apps, and theme parks) as The Walt Disney Company has a radically different business model with four operating segments (parks, experiences and products, media networks, studio entertainment, and direct to consumer international). (See my article on “Data Science, Disney, and the Future of Children’s Entertainment.”) Here, studio films and story world spin-offs function as marketing in franchise storyworlds, whereby each new film or series drives consumer activity across other segments. You can play in Andy’s Back Yard in Toy Story Land at Disney World AND keep your toddler dry in Buzz and Woody branded Huggies Pull-Ups.

Viewer data will complete TWDC’s business model vertical integration, as data intelligence will fuel future content development. While branded movie merchandising has been around since George Lucas savvily retained the rights to Star Wars merch, Disney’s development and production of multi-million dollar feature films function in a media franchising business model that CEO Bob Iger shared when he was appointed in 2006: “The case I laid out was that by creating and then supporting franchises, it could impact the bottom line of the whole company in a very profound way and everybody would benefit from that.” From Marvel, to Frozen, to Star Wars, Pixar and beyond, one can trace the logic of franchise media expansion across all of TWDC’s decisions. If Disney+ remains ad-free, data presumably will not be shared with third parties for ad generation.

With multiple Star Wars storyworld extensions in the works, The Mandalorian is the tip of the iceberg that potentially leads to a holiday at Galaxy’s Edge, Disney World, where you can fly the Millennium Falcon, or have your first legal drink in the Cantina, as a student of mine just did.

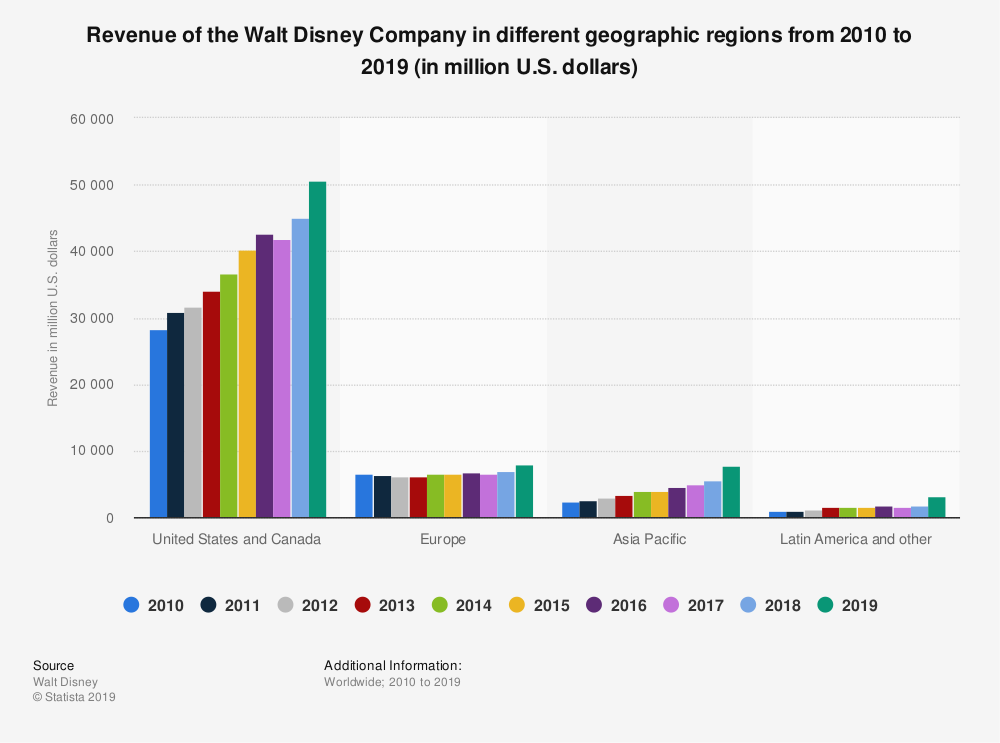

Iger’s multi-year strategy to consolidate TWDC’s control over all verticals in its market offerings, cable, content, and theme parks, means that each film functions as the first wave of a juggernaut of merchandise, theme park attractions, and new streaming offerings. TWDC’s control of the box office market share globally this past year was an astonishing 7 out of 10 top grossing films worldwide, and 8 out of 10 domestically, with 38.2% of the American box office (33.2% Disney produced and 5% 20th Century Fox). The revenue total for box offices worldwide shattered $11.13 billion, which sounds like a lot, and is comparatively. In 2019, the parks, experiences, and products segment finally surpassed media networks (cable) at $26.23 billion vs. $24.83 billion, with direct-to-consumer & international at $9.35 billion.

Ants and elephants. Where TWDC invests in blockbusters that can extend story world franchises endlessly (see two? three? possible Star Wars trilogies, and multiple serial spin-offs glutting screens for the next decade), Netflix is now famous for not renewing multiple popular, lauded series beyond a second season because their data shows that these rarely attract new subscribers past Season 2 (see The OA, Sense8). There are of course exceptions (Orange is the New Black, Stranger Things). More good-enough content, with the occasional binge hit or premiere auteur title segmented across 190+ national markets, makes Netflix enormously flexible, agile, and responsive, to borrow tech innovator/industry terms. Disney is the opposite. What new CEO Bob Chapek (ex-Chairman of Disney Parks) and TWDC will do developing content for Hulu and Disney+ is anybody’s guess. Perhaps we will see more experimental, non-mainstream content. Perhaps. Currently, 20th Century Fox/James Cameron’s Avatar (2009) will be rebooting with four sequels running between 2021 to 2027. At least we stand a good chance of being entertained while this “streaming war” unfolds.

Image Credits:

- The Mandalorian premiered with the launch of Disney+ on November 12, 2019.

- Marvel Studios previews three of its upcoming Disney+ series during Super Bowl LIV.

- Revenue of the Walt Disney Company in different geographic regions from 2010 to 2019 (in million US dollars).

- Netflix streaming subscribers by quarter.

- Huggies Pull-Ups are available in a variety of Disney brands, including Pixar’s Toy Story.

- Photo of the 1 millionth rider on the Millennium Falcon ride at Galaxy’s Edge.

NetFlix is a good brand for global online television. Good quality and bring many benefits to users. I have used mobdro before but when I knew NetFlix, this was the most gratifying experience no application had ever surpassed.